Travel Expense Reimbursement Tax Authority Guide

Mileage Allowance for Employees

What is a Travel Allowance, and is it Mandatory?

A travel allowance is, simply put, a contribution toward the costs you incur when traveling for work. This usually covers business trips or commuting.

However, note that an employer is not required to reimburse travel costs. You are only officially entitled to it if this is set out in writing—for example, in a collective labor agreement (CLA), employment contract, or company policy.

Many employers do choose to compensate their employees (in part). This can be arranged in various ways, such as:

- a fixed amount per kilometer,

- a commuting allowance,

- or an allowance for other business trips.

Whether you are an employee or an employer, the rules may vary depending on the situation.

👉 Are you an employer looking to provide a fair and tax-efficient allowance? Then consult our comprehensive guide for employers.

How much Mileage Allowance Do You Receive as an Employee Using your Own Car?

Do you drive your own car for work? Your employer can provide a mileage allowance for this.

Each year, the government sets a standard per-kilometer rate that may be reimbursed tax-free. This amount may change; you can always find the current rate on the websites of the central government or the Tax and Customs Administration.

Does your employer pay more than this official rate? That is permitted, but payroll tax must be paid on the excess.

An employer may choose to:

- Reimburse only your commuting.

- Or reimburse only other business trips.

Important to know: if you receive a mileage allowance, you will typically need to keep a trip log. This proves that the claimed kilometers were genuinely driven for business.

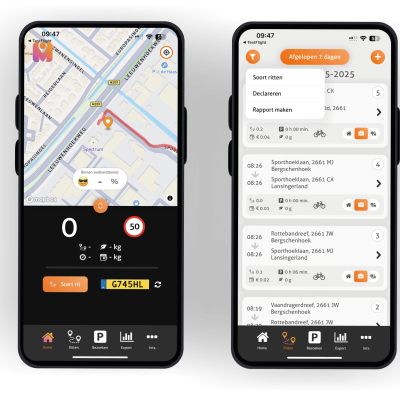

A smart trip-tracking app makes this much easier—you no longer need to maintain a manual logbook and always have a complete overview ready.

Can You Receive a Mileage Allowance as an Employee when Carpooling?

Yes, you may still be entitled to a mileage allowance when carpooling. How this works exactly depends on who initiates the carpool.

-

Carpool arranged by the employer

In that case, the employer may reimburse the driver at the official tax-free mileage rate. Detour kilometers (the extra distance driven to pick up colleagues) are also covered. -

Carpool arranged by employees themselves

In this scenario, each employee may receive an allowance for their own kilometers. Note: the driver’s detour kilometers are not tax-free in this case.

In short: carpooling can still result in a travel allowance, but the rules differ slightly depending on who organizes the carpool.

What if You Use a Company Car as an Employee?

Do you drive a company car? Then your travel allowance works a bit differently.

Because your employer already covers the car’s costs—such as fuel, insurance, maintenance, and road tax—you generally will not receive a separate mileage allowance. The car itself is your allowance.

Do keep the following in mind:

-

Business trips are fully covered by the employer.

-

If you also use the car privately, you will be subject to a taxable benefit (bijtelling). This is an amount added to your taxable income by the Tax and Customs Administration, depending on the car’s list price and CO₂ emissions.

-

Commuting is regarded as private use unless agreed otherwise.

In short: a company car saves you substantially on car expenses, but the taxable benefit can affect your net income.

Do You Hardly Use your Company Car for Private Purposes?

If you use your company car only for work and at most a few times privately, you can officially record this with a ‘Declaration of no private use of company car’ with the Tax and Customs Administration.

What does this entail?

-

You declare that you drive no more than 500 km per year for private purposes.

-

Your employer will then not apply the taxable benefit.

-

You will therefore retain more net salary.

There is a caveat: the Tax and Customs Administration may always request evidence. A thorough mileage log is therefore crucial. Without this record, your declaration carries little weight.

👉 That is why many employees (and employers) choose an app that automatically tracks all trips. This way, you need not worry in case of an audit.

Separate rules apply to vans. We will not delve into those in this article. If you would like to explore them, you will find the details in the Payroll Tax Handbook, section 23.4.

How Does a Travel Allowance Work with Lease Cars?

Lease cars come in two types—and the rules for your travel allowance differ by situation:

-

Lease car provided by your employer

If your employer provides a lease car, the same rules apply as for a company car. All costs (fuel, maintenance, insurance) are already covered. You therefore do not receive a separate mileage allowance. However, a taxable benefit may apply if you also use the car privately. -

Private lease car

If you sign a lease contract yourself (private lease), the Tax and Customs Administration regards the car as private property. In that case, your employer may provide a tax-free mileage allowance for your business trips and commuting, up to the official per-kilometer rate.

In short: with an employer-provided lease, the car is your allowance; with a private lease, you can claim as if it were your own car.

Public Transport Travel Allowance: how Does it Work?

Yes, if you travel by train, bus, metro, or tram, you can receive a travel allowance from your employer. It must, of course, concern business trips, such as commuting or visiting a client.

Your employer has several options:

-

Reimburse the actual costs (for example, based on your public transport receipts).

-

Apply a fixed amount per kilometer.

-

Provide a season ticket or mobility card.

Anything within the official tax-free rate may be reimbursed without tax. If your employer pays more than that rate, payroll tax will be withheld on the excess.

In short: your public transport journey can be reimbursed just fine, provided your employer arranges it properly and you can present the appropriate supporting documents.

Can Employees also Receive a Fixed Travel Allowance?

Yes. Instead of submitting individual claims per trip, your employer can provide a fixed monthly allowance for your travel.

With such a fixed amount, you choose how to travel—by car, public transport, or a combination. Convenient for both employee and employer, as it reduces administrative work.

Important to know:

-

This allowance may be paid tax-free up to the official tax-free rate.

-

If you receive more than this rate, payroll tax will be withheld on the excess.

In short: a fixed travel allowance gives you more flexibility and less hassle with receipts or individual logs.

Work-related Expenses: What Exactly should You Record?

Are you applying for a mileage or other travel allowance? Then it is important to document the correct information accurately.

👉 This varies by situation:

-

Company car

Additional costs such as parking fees, tolls, ferries, or even cleaning costs can be reimbursed separately—if agreed with your employer. -

Private Vehicle

The official tax-free mileage rate applies here. If parking fees or tolls are reimbursed additionally, the Tax Authorities consider this as taxable income (unless the employer covers this under the work-related expenses scheme – WKR).

What Must You Always Record?

- Your mileage (business and, if applicable, private).

- Receipts for parking fees, tolls, and other work-related expenses.

Comprehensive record-keeping is mandatory – and prevents disputes during audits.

How Can You Track this?

-

Using a mileage logbook or an Excel spreadsheet.

-

With a smart trip registration app that automatically records your mileage and expenses. This way, you will never forget a trip and will always have a report that meets the requirements of the Tax Authorities.

👉 Are you unsure about which data is mandatory in your situation? Always consult with your employer or check the guidelines of the Tax Authorities.

Mileage Allowance for Self-Employed Individuals

- How many cents per kilometer are you allowed to charge as a self-employed individual?

- What other car expenses can self-employed individuals claim?

- How can you track your mileage allowance as a self-employed individual?

As a self-employed individual, you are often on the road: to a client for an appointment, visiting a potential lead, or working on-site. These are necessary trips that naturally incur costs. Fortunately, you can partially pass on or deduct these costs.

The good news is: as a self-employed individual, you are not subject to the standard ‘statutory travel expense allowance’ that applies to employees. Therefore, you have more freedom to determine your own rate and make smart use of the fiscal opportunities.

In this article, we explain step by step:

- How to determine how much you can charge per kilometer.

- What other car expenses you can include.

- And most importantly: how to accurately track this for the Tax Authorities without hassle.

Spoiler: with the right tool, you can automate your trip registration instead of it being a time-consuming task.

How many Cents per Kilometer are You Allowed to Charge as a Self-Employed Individual?

As a self-employed individual, it’s not just about the kilometers you drive. Your car naturally incurs more costs – and you can (partially) reimburse those as business expenses. Consider, for example:

- Maintenance and repairs – from tires to major service.

- Depreciation – the decrease in your car’s value.

- Car insurance – including third-party liability or all-risk.

- Fuel – often convenient to track this with a business fuel card.

- Road tax – the portion your car is used for business.

- VAT – which you can reclaim in many cases.

How do you calculate your actual mileage allowance?

Simply add up all your car expenses for a year and divide that amount by the number of kilometers you drive in the same year.

This way, you immediately see what a kilometer truly costs you and know whether the reimbursement you charge your client is sufficient to cover your actual expenses.

How Do You Track your Mileage Allowance as a Self-Employed Individual?

You know you can claim a mileage allowance – but how do you accurately track all those trips for yourself and the Tax Authorities?

The classic method is to keep a logbook. But honestly: that takes a lot of time and discipline. Recording each trip individually… that’s not a pleasant task.

A slightly more modern option is a mileage registration form. Convenient, but still a lot of work and prone to errors.

The smart solution? A trip registration app. With it, you put your administration on autopilot.

With an app, you can, for example:

-

Have your mileage automatically registered.

-

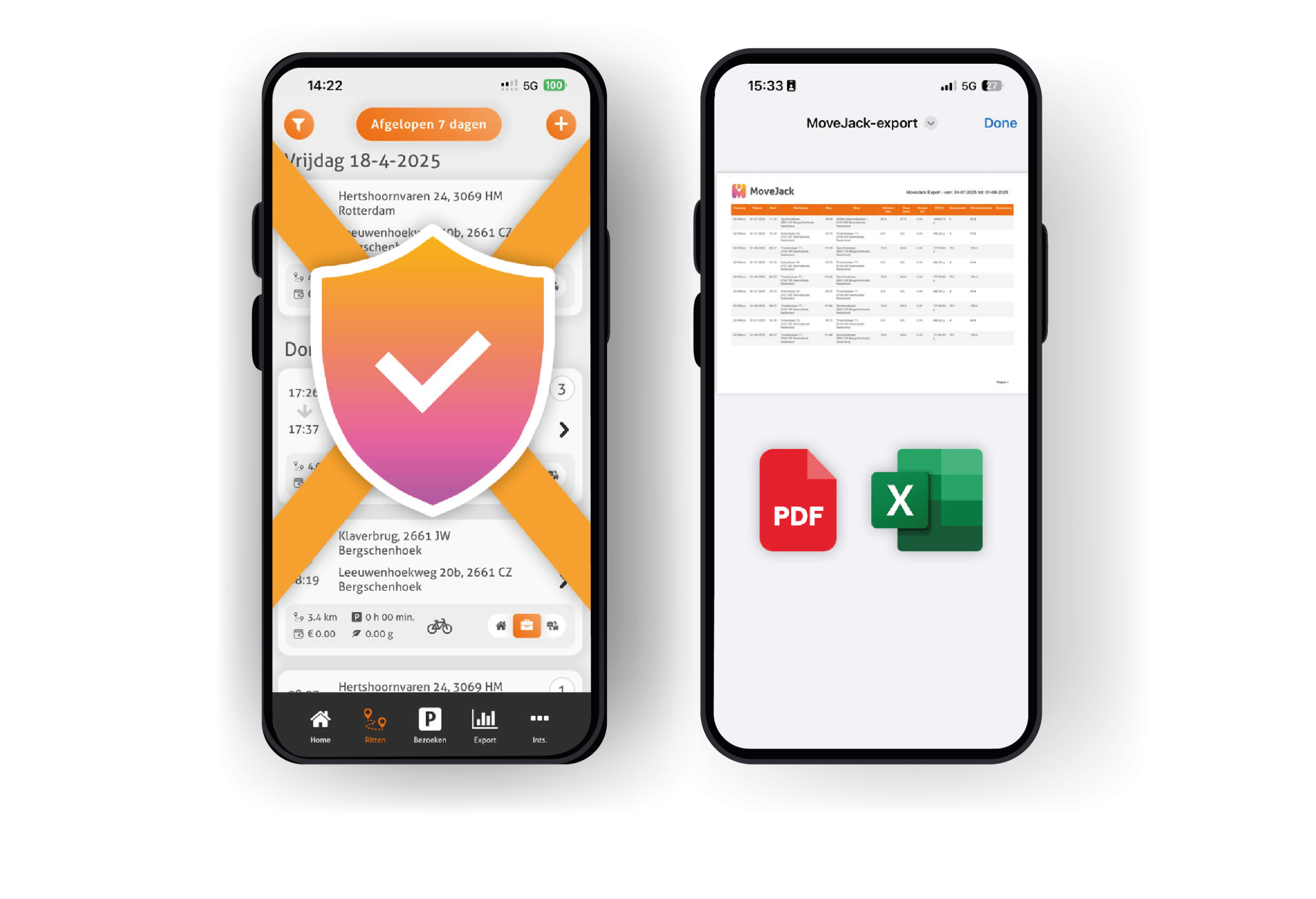

Generate reports that directly meet the requirements of the Tax Authorities.

-

Set your own mileage rates.

-

Easily label trips as business or private.

-

Never forget trips again – the app automatically records your movements.

-

Securely store your data and always retrieve it later.

This way, tracking your mileage allowance suddenly becomes hassle-free, simply part of your workflow.

With MoveJack, this becomes even easier. Your trips and hours are automatically recorded, locally on your phone – without cloud and without worries. One press of a button and you have a comprehensive report ready for your administration.

What other Car Expenses Can Self-Employed Individuals Claim?

As a self-employed individual, it’s not just about the kilometers you drive. Your car naturally costs you more than that, and fortunately, you can include many of those expenses as business costs. Consider, for example:

Maintenance and repairs – from a set of new tires to a major service.

Depreciation – the decrease in your car’s value due to use.

Car insurance – whether you are insured for third-party liability or all-risk.

Fuel – often convenient to track this with a business fuel card.

Road tax – the portion your car is used for business purposes.

VAT – which you can reclaim in many cases.

How do you calculate your actual mileage allowance?

Add up all your car expenses for a year and divide this amount by the number of kilometers you drive in the same year.

This way, you discover what a kilometer truly costs you and immediately know whether the reimbursement you charge your client is sufficient to cover all your expenses.

With a smart trip registration app like MoveJack, you always have this insight at hand – automatically and without the hassle of loose receipts or Excel lists.

Tips for Comprehensive Trip Registration

- What is trip registration?

- What should your trip registration contain?

- Do you also need to register private trips?

- How can you track mileage for comprehensive registration?

- Practical tips to avoid errors

Tracking your trips might sound complicated, but it doesn’t have to be at all. With the right approach, you make your administration not only comprehensive, but also clear and stress-free.

In this guide, you will read:

- What information must be included in your trip registration.

- How to prevent making errors or forgetting trips.

- And smart ways to automate everything, so you always meet the requirements of the Tax Authorities.

👉 In short: this article provides you with all the tools to register your mileage correctly and efficiently, with a few extra tips that will save you a lot of time and hassle.

What is Trip Registration?

Simply put, trip registration is an overview of all your business and private trips. It is your proof to the Tax Authorities that you use the car as declared in your tax return.

Why is this so important?

-

The Tax Authorities apply clear guidelines for what trip registration should look like.

-

If you do not adhere to them, you may still have to pay tax.

-

During an audit, a fine may even follow if your administration is not comprehensive.

In short: trip registration is not a formality, but a way to protect yourself. It gives you control over your business mileage and ensures that you are never caught by surprise.

👉 Good news: with a smart tool or app, you no longer need to track this manually. This way, you automatically comply with the rules and save yourself a lot of time.

What should your Trip Registration Contain?

If you maintain trip registration, there are a few things you must always note down. Here is an overview of the basic data you must include on your mileage registration form:

-

Vehicle information:

-

The vehicle model

-

The vehicle type

-

The vehicle’s license plate number

-

The period during which you used the vehicle

-

-

Travel data:

This is where it might seem a bit more complicated, but don’t worry, it’s manageable. Your trip data should include the following:-

Date of the trip

-

Starting and ending odometer readings

-

Departure and arrival addresses of the trip

-

Route taken (only if you did not take the most common route)

-

Business or private trip (this is crucial)

-

Private detour kilometers (if you make a detour for private purposes during a business trip, such as picking up children from school)

-

Special Situations

In some cases, there are simplified rules, for example, for driving instructors or couriers who drive a lot of kilometers. If this applies to you, please check the Trip Registration page of the Tax Authority for more information.

An automatic trip registration app makes all of this easier and ensures you don’t forget anything!

An Automatic Trip Registration App Makes all of this Easier and Ensures You Don't Forget Anything!

Yes, even if you use your vehicle privately only to a limited extent (for example, less than 500 kilometers per year), you must register those trips as well. Why? Because you need to be able to demonstrate which portion of the trips were for business purposes.

The Tax Authority looks at the percentage of trips that are business-related compared to the total number of kilometers driven (both business and private).

In short: you must keep track of all trips, both for work and private purposes.

A handy app makes tracking these trips super easy and prevents you from forgetting trips. This way you always stay within the rules and save time!

How Can You Record your Kilometers for a Complete Trip Registration?

There are various ways to keep track of your trips, and you can choose what works best for you. The most common methods are:

- Physical logbooks

- Spreadsheets

- Apps for mileage tracking

You can choose how you keep track, but it is wise to check whether your method meets the requirements of the Tax Authorities. You can do this via the ‘Setting up records for your tax returns’ page of the Tax Authorities.

Our Recommendation: Use a Trip Registration App

We recommend using a trip registration app. It eliminates the hassle of manual entry. Everything is recorded directly in your digital logbook, and you can easily generate a report that you always have on hand for your tax return.

More reliable: the data cannot be altered, ensuring a complete record.

- More reliable: the data cannot be altered, ensuring a complete record.

- More accurate: you record the kilometers exactly as you have driven them, without forgetting anything.

- More accurate: you record the kilometers exactly as you have driven them, without forgetting anything.

So, do you want to keep your records simple and reliable? With a mileage tracking app, you are always well prepared.

Other Tips for a Complete Trip Registration

Keep a clear record of your trips quickly and easily with these tips:

-

Know the requirements of the Tax Authority

If you know exactly what rules the Tax Authority sets, you can keep your trip registration in order. Check out the page ‘Setting up a record for your tax returns’ on the Tax Authority’s website. -

Keep your registration up to date

Don’t wait too long to fill in your trips, otherwise, you might forget where you went. For example, set a reminder in your calendar to update your trips every Saturday, so you always stay up-to-date. -

Make a clear distinction between business and private trips

This way, you can correctly justify your trips during an audit. -

Use automatic trip registration

Don’t want to keep track of everything manually? Use automatic trip registration. This way, you can keep your records complete and save time.

With these tips, you can quickly and easily keep your trip registration in top shape.

Insight down to the smallest details

From distance and average speed to your exact route on the map: your trips are fully transparent. You can see how much you have driven, how long you stayed at a location, and whether you are (tax-wise) entitled to reimbursement. You can modify trips, delete them, or manually add detour distances and comments.

Ready for accounting and expense claims

Filter easily by trip type and period, manually add trips, and choose exactly which ones you want to claim.

Create clear reports for your administration or tax return with just a few clicks. It’s also ideal if you just want insight into your camper kilometers or daily mileage.

Smart search and quick retrieval

Easily search by address and immediately see all trips you have made there – including date, time, distance, and costs. Ideal if you often visit the same location or need to quickly find something for your administration or audit.

Everything tracked automatically

MoveJack automatically registers every trip via GPS. You can see exactly when you departed, where you arrived, which vehicle you used, and whether the trip was business, private, or commuting. Have you saved fixed addresses? Then the trip type is automatically filled in – very convenient.